Option Samurai Blog

Learn. Trade. Profit.

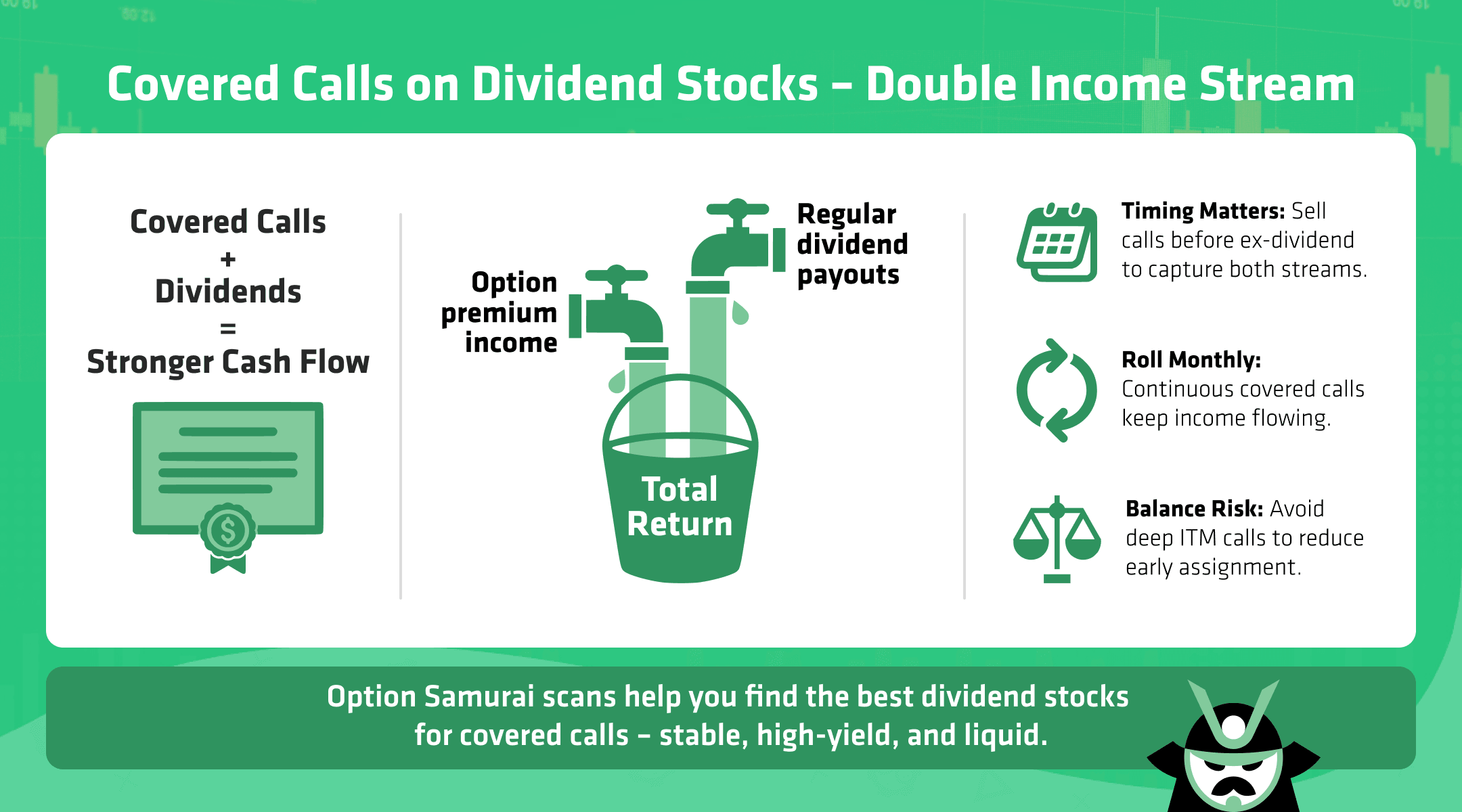

Covered Calls on Dividend Stocks - Monthly Income from Quality Companies

How do you find the best dividend stocks for covered calls, and when should you sell for a covered call dividend?

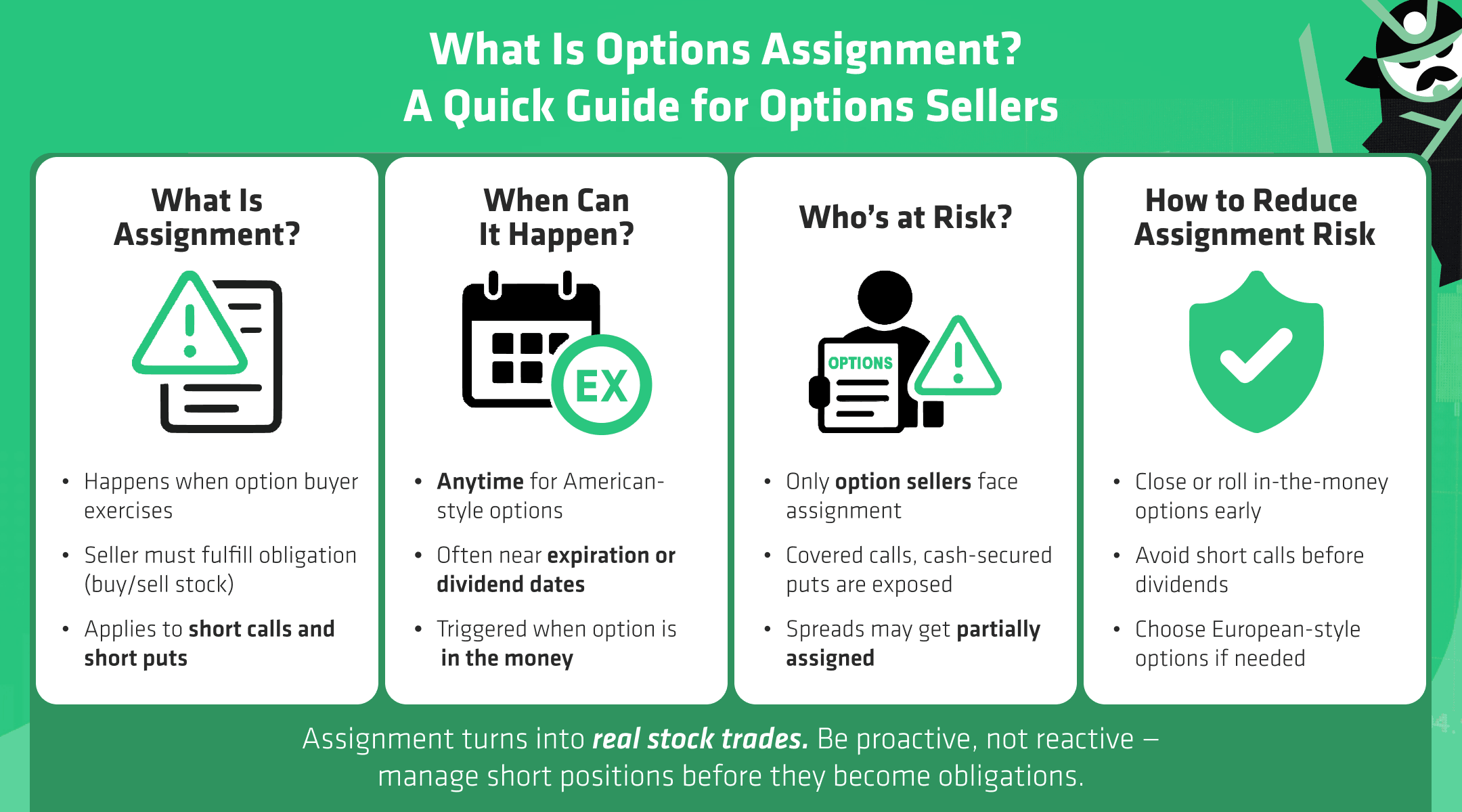

Options Assignment - When It Happens and What to Expect

Options assignment is a key concept in options trading, especially for those who sell options who may incur into the so-called assignment risk.

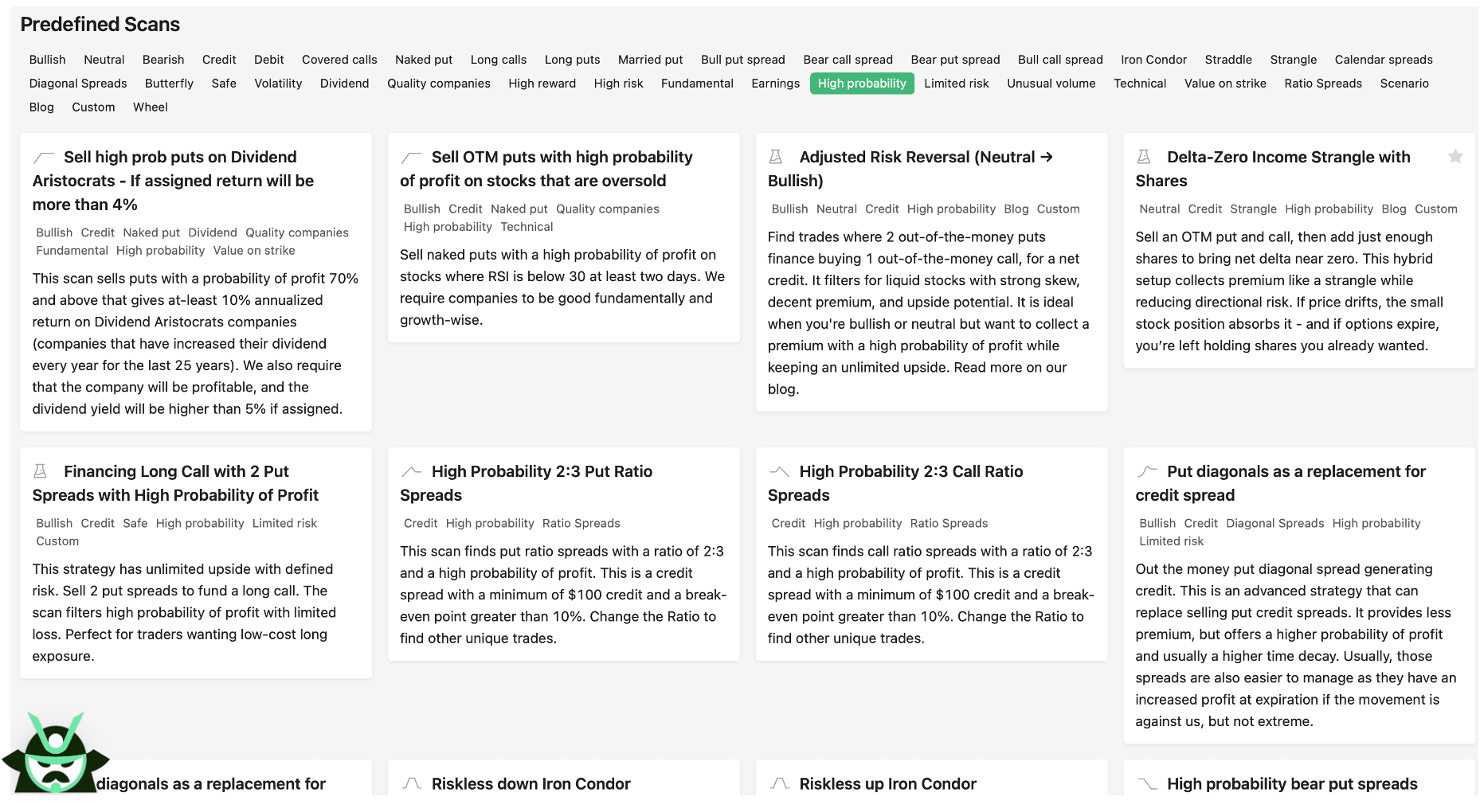

High Probability Options Strategies with Low Risk and Strong Edge

Discover high probability options strategies like put selling, iron condors, and ratio spreads. Low risk, high edge trades with defined probabilities.

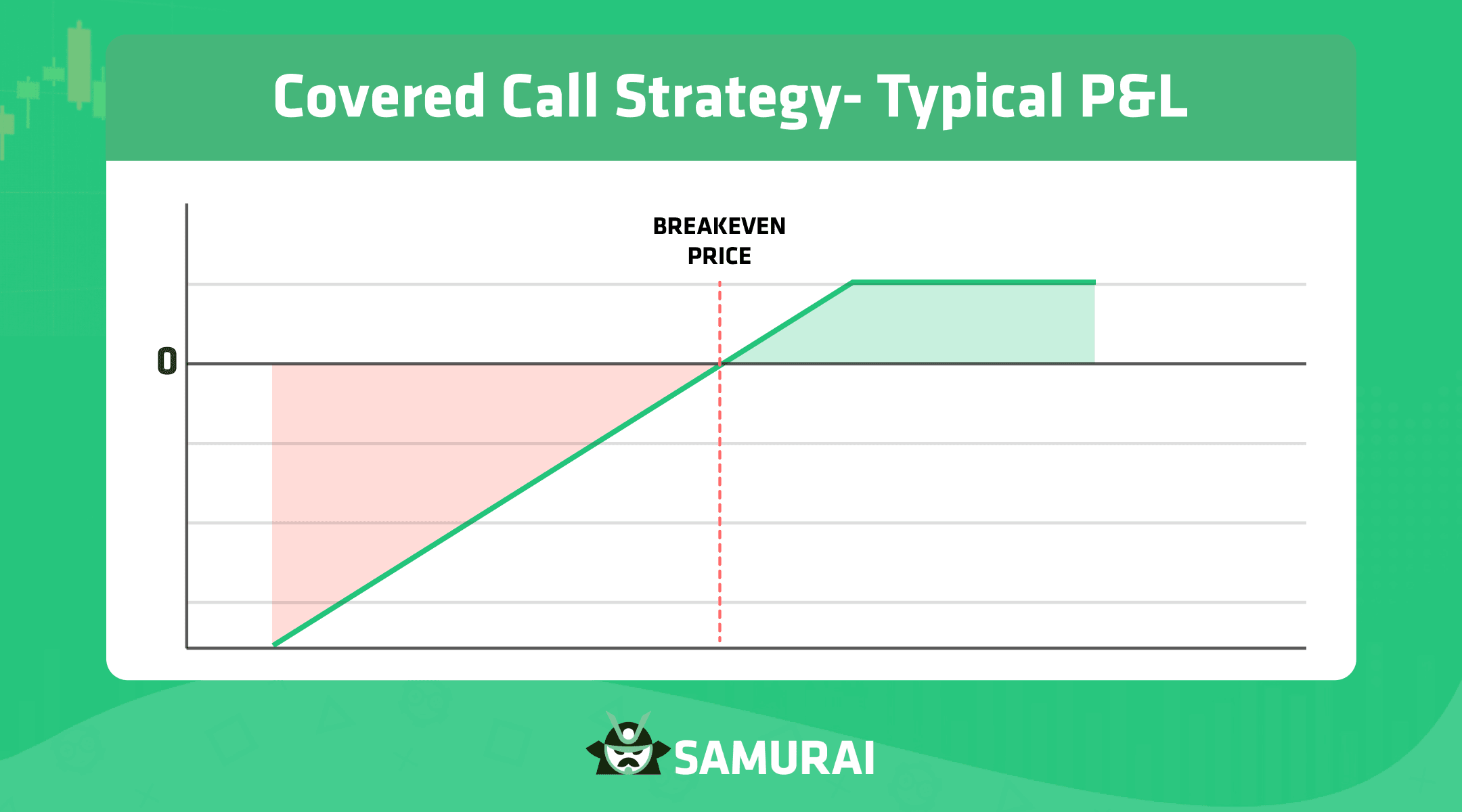

Covered Call ETFs - A Guide for Income-Focused Investors

Learn more about covered call ETFs, what they are, how they work, and the main risk and benefits involved in them.

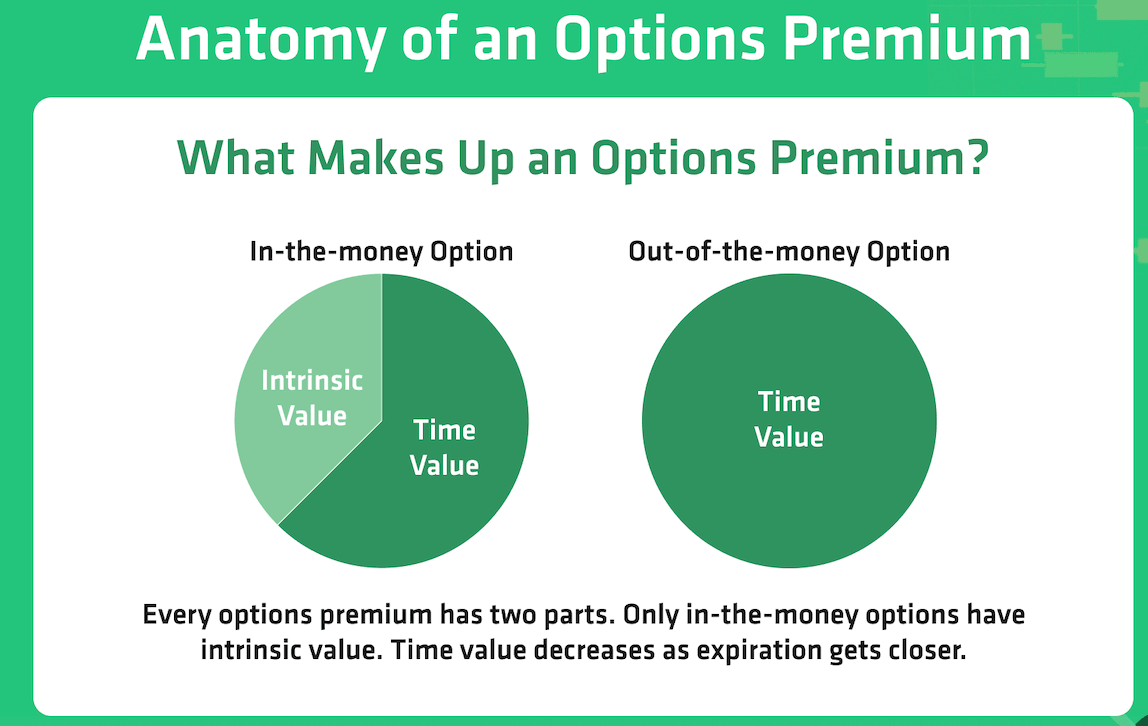

Options Premium - What It Is and Why It Matters for Traders

This article looks at how call option premium and put option premium are priced, what moves them, and why understanding options premium can improve your decisions as a trader.

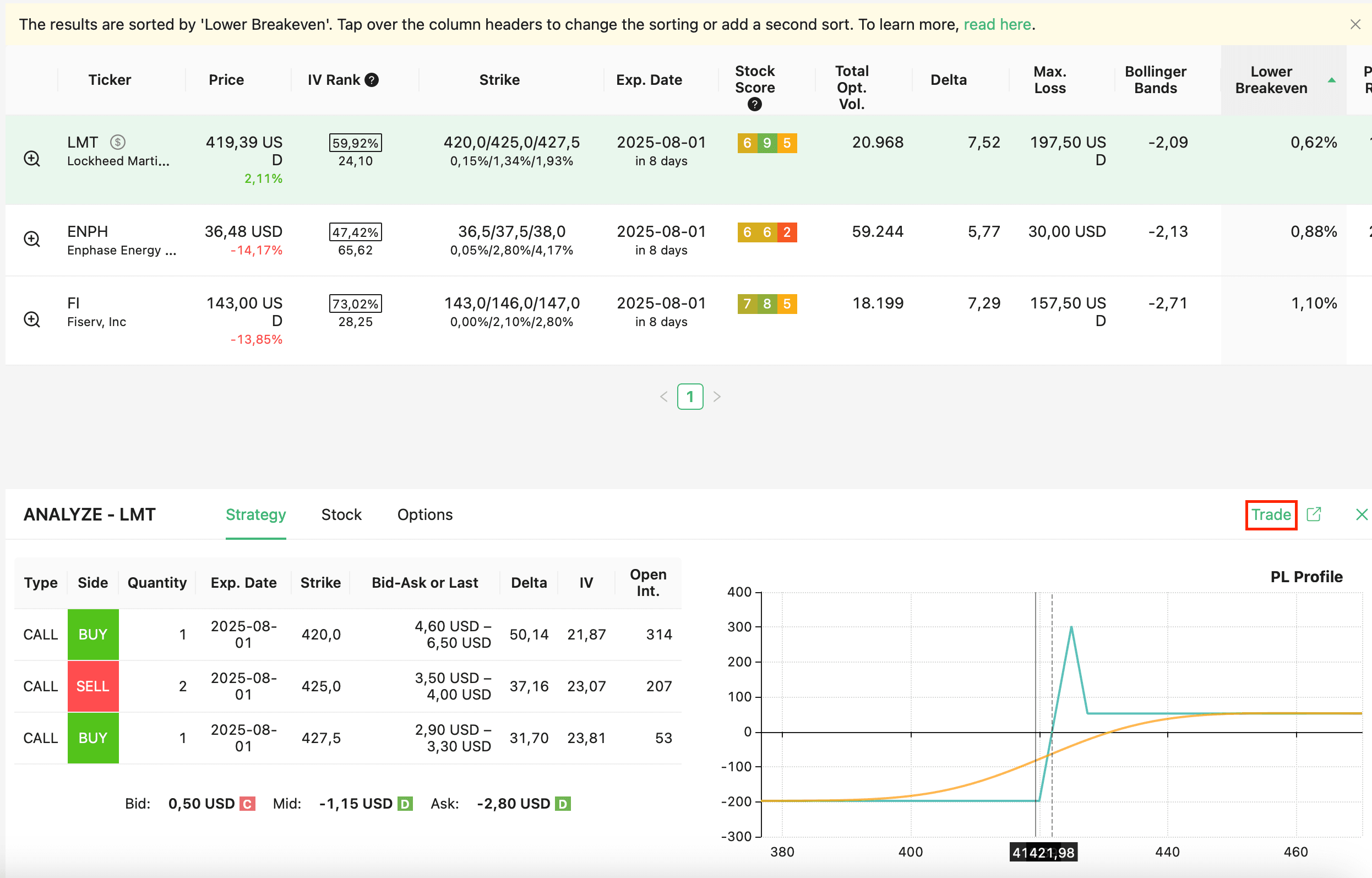

New Version for Option Samurai – Q3 2025

We’ve enhanced the Custom Option Strategy Scanner and added powerful new features: saved scan lists, predefined scans, Excel templates, and a backtest on our exclusive OI Report showing a measurable edge. Plus, site upgrades and bug fixes make Option Samurai smoother than ever.

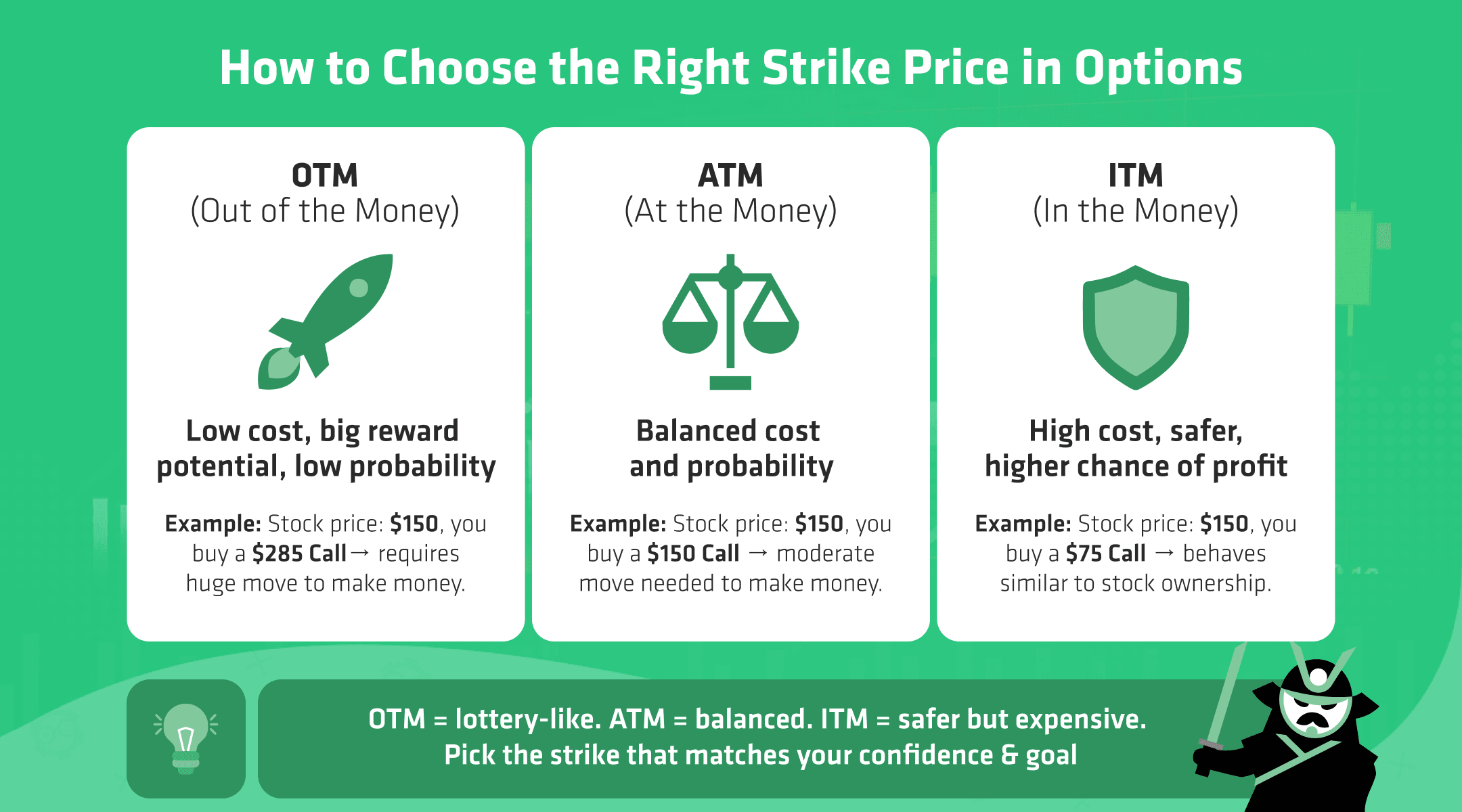

How to Choose the Right Strike Price for Options? Understand Risk vs Reward in Seconds

Learn how to choose the right strike price for options based on your strategy, risk tolerance, and market outlook.

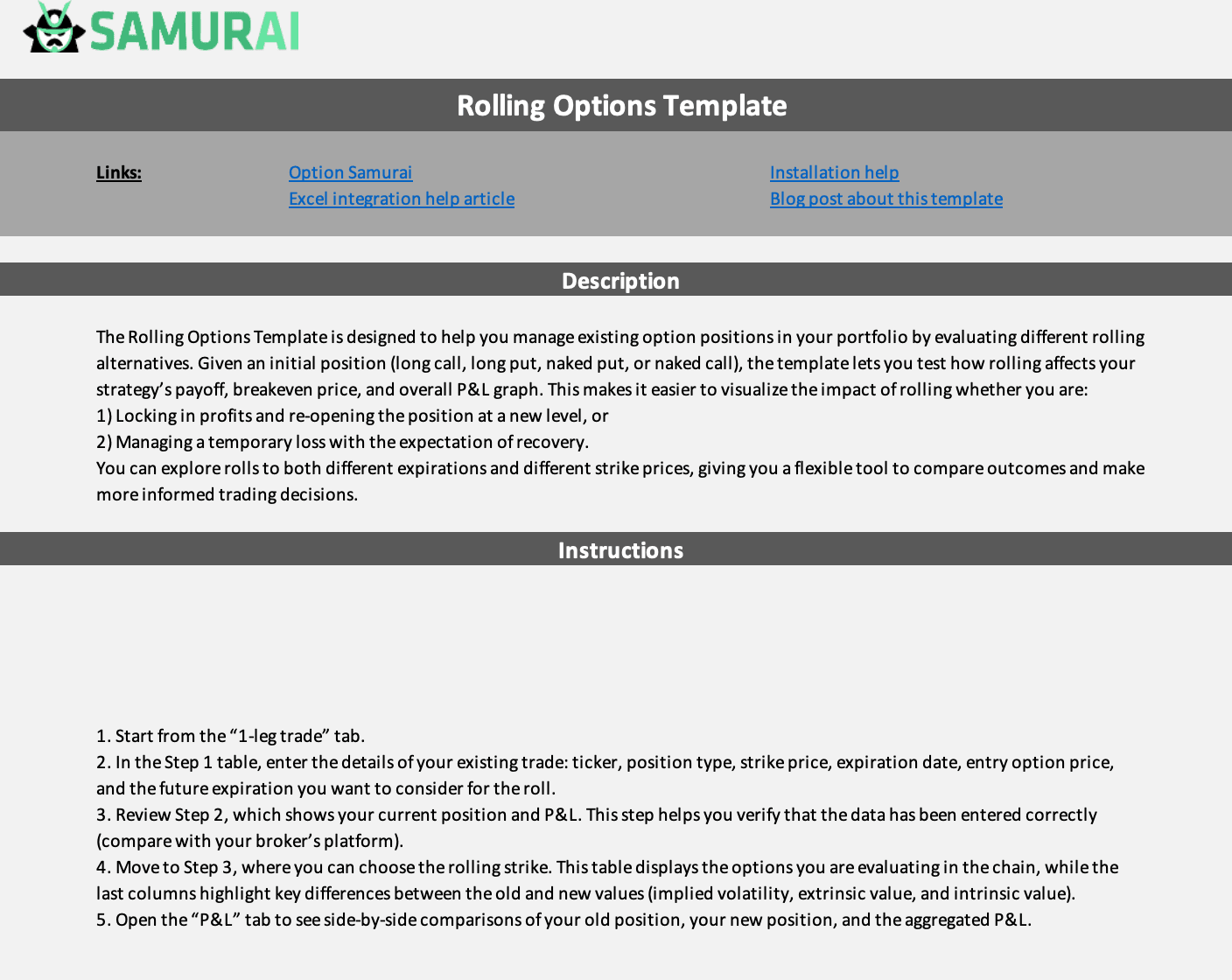

How to Use the Rolling Options Template

Learn how to use the Rolling Options Template to adjust option trades. Step-by-step guide with P&L visuals, breakeven analysis, and best practices.

Collar Payoff Calculator Template - Visualize P&L, Fees, and Dividend Impact

Use Option Samurai’s collar calculator template to test bullish or bearish collars, include dividends, check risk-free trades, and log them fast.

How Long Does It Take to Learn Options Trading? Building Skills That Last

How long does it take to learn options trading? The short answer is: it depends. Learning the basics is quick, but building the skills to trade with confidence takes time.